straight life policy term

Get 250000 in Coverage for as Low as 10month. Free Quotes Instantly From Top-Rated Carriers.

Whole Life Vs Universal Life Insurance

Straight Life An annuity or other insurance plan that provides the policyholder with monthly payments for the remainder of hisher life.

. Ad Compare the Best Life Insurance Providers. Apply Online in Just Minutes. Life Paid-up at Age 65 D.

A straight term insurance policy provides a benefit upon the death of the policyholder but ceases to provide. A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or a death benefit. Give Your Family Security with Term Life Insurance from SelectQuote.

It is also known as ordinary life insurance. Straight life insurance is a type of permanent life i nsurance that includes a cash value account that grows over the policys life. Ad Americas 1 Term Life Insurance Company.

Life Paid-Up at Age 70. Life Paid-up at Age 65. Most term life insurance policies offer a level death benefit and premiums for 10 to 30 years though some companies offer coverage for five years and as much as 40 years.

Ad Get 250000 in Coverage for as Low as 10month. Which of the following is an example of limited pay life policy A Level Term Life B. Get a Free Quote or Apply Online.

Ad No Exam Just Health Other Info. A life insurance policys cash value is distinct from the death. A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or a death benefit.

Ad No Exam Just Health Other Info. As with all whole life. A life insurance policy that provides coverage only for a certain period of time.

Definition Straight Life Policy an ordinary life policy or whole life policy. Learn the benefits of straight life insurance for individuals families and business. It pays out a death benefit.

Term life policy While straight life insurance offers lifelong coverage term life insurance provides temporary life insurance coverage. Rates starting at 11month. A straight term insurance policy provides a benefit upon the death of the policyholder but ceases to provide.

After death however the payments cease and the. See how a straight life policy compares to term or universal life. 2022 Editors Top Reviews.

A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments. Whole life insurance is a type of life insurance that provides coverage for the entirety of the policyholders life and has a savings component. Straight Whole Life Insuranceor ordinary life provides permanent level protection with level premiums from the time the policy is issued until the insureds death.

Rates starting at 11month. Renewable Term to Age 70.

Term Life Insurance Vs Accidental Death And Dismemberment Nerdwallet

How Return Of Premium Life Insurance Works Nerdwallet

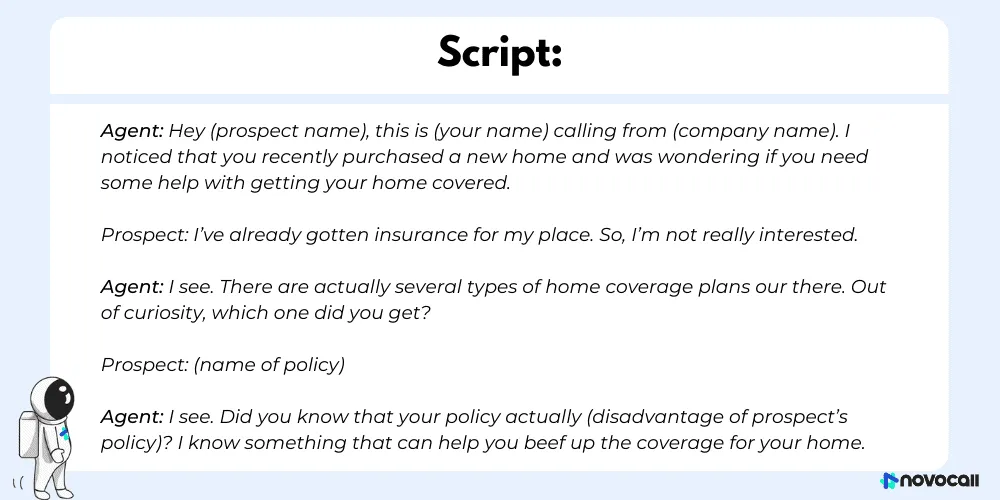

9 Best Cold Calling Scripts For Insurance Agents

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

Whole Life Insurance Definition

Super Straight Meaning Trolls Started Transphobic Social Campaign

Understanding Section 7702 Plans Bankrate

Straight Line Equations Definition Properties Examples

Joint And Survivor Annuity The Benefits And Disadvantages

What Is Whole Life Insurance And How Does It Work Lincoln Heritage

Choose From Range Of Life Insurance Plans And Term Insurance Plans Along With Other Policies Suc Life Insurance Marketing Life Insurance Quotes Term Insurance

What Is Whole Life Insurance And How Does It Work Lincoln Heritage

Straight Line Equations Definition Properties Examples

Lcx Life A Life Insurance Settlement Company Life Life Insurance Health Challenge

6 Reasons Why You Should Get Health Insurance

Cash Value Life Insurance Is It Right For You Nerdwallet

Whole Life Insurance Definition

How Return Of Premium Life Insurance Works Nerdwallet

24 7 Access To Attorneys When You Have Your Legalshield Wallet Card Or Key Tag Universal Life Insurance Life Insurance Policy Legalshield

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)